Managing Change: Employee Engagement During A Merger or Acquisition

Companies that decide to grow through a merger or acquisition need to bring teams together in strategic ways that demonstrate forethought, finesse, and focus. The longer leadership waits to integrate cultures in a deal, the more complex the task becomes.

Reducing internal friction can assure positive employee engagement

When mergers and acquisitions occur, employees may wonder where they fit into the bigger picture based on the direction of the company. It’s natural for anyone to feel anxious and a little out of the loop. And it’s not unusual for friction to build throughout the ranks. 1 in 5 employees voluntarily resign following merger announcements. To avoid internal friction and reduce employee turnover, it’s best to be proactive and plan your internal communication strategy as early as the due diligence phase.

Discover our four tips to help your business reduce the potential negative effects that mergers and acquisitions can have on employees, and champion positive and purposeful change for all.

Tip #1: Help your team align on the strategic acquisition

First, you’ll need to break the news to employees that a merger or acquisition has happened. This is your chance to align your teams early on in the strategic acquisition, preventing reactions of shock or confusion. That’s why communicating openly and honestly in a timely fashion about how the M&A event affects employees is a critical measure for leadership to take.

Don’t be surprised if you’re hit with questions from every direction. When employees hear about an M&A, the first thought that pops into their head will likely be, “Do I still have a job?”

Alleviate this tension as soon as possible by anticipating your employees’ questions and answering them before people have a chance to worry. Let your staff know as soon as possible about the status of their jobs and salaries. Then, communicate what the next steps will be and make yourself available to answer any questions that might arise.

Tip #2: Have an employee engagement strategy in place early

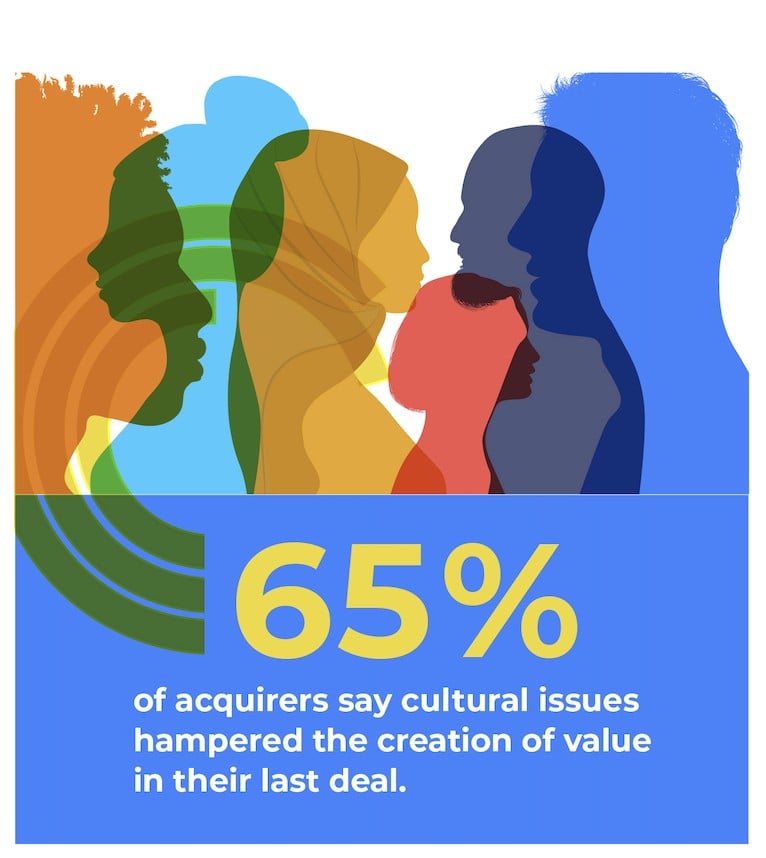

If you don’t have an employee engagement strategy already, now is the time to build one. Savvy leaders agree that it’s wise to think about an employee engagement strategy during the due diligence phase. It’s never too early to figure out the culture equation. That means investing in resources to effectively determine cultural differences before the deal happens, as well as enlisting leaders in understanding, pre-emptively problem-solving, and guiding teams to act.

“Merger Syndrome” describes the presence of uncertainty and anxiety that employees can face during a merger or acquisition. No matter how clear you were in making the initial M&A announcement, employees may still feel anxious and distracted below the surface. Minimizing ambiguity is a good way to remove gray areas that can lead to misinterpretations or negativity.

In our 7 Truths of M&A Branding blog, we point out that an M&A event is much more than a simple brand refresh. Leadership must recognize that the experience is a significant business transformation and must do everything possible to ensure that the new brand is built from the inside out with internal audiences in mind.

You can engage your employees by:

- Planning a company celebration; keep it fun and don’t skimp on the swag!

- Providing time off; an awesome de-stressor

- Offering rewards like gift cards or a free lunch; symbols of gratitude

- Publicly recognizing employees for their contributions

- Consistently thanking staff for their dedication; great positive reinforcement

The employee engagement strategy you implement should be designed with the future built-in. You should expect the strategy to perform through the entire integration process and be adaptable to the future culture the company is trying to create.

Source: PwC’s Creating value beyond the deal report, Mergermarket

Tip #3: Reduce friction by reinforcing company culture

When an M&A event occurs, it can be challenging to define the company culture. But it’s a crucial step to addressing concerns in order to stave off defections. This is especially true if a strong company culture is the reason most employees have remained at the company.

Engaging and retaining talent from an acquisition has proven to be critical to deal value. Yet taking the right approach—during integration and for post-M&A—remains challenging. Leadership must be sure to provide clarity and direction to key people and manage change through the integration.

Corporate executives understand that people are integral in M&A, and the companies that devote more time, attention, and resources to people early in the deal life cycle tend to enjoy greater success. As we’ve mentioned in previous steps, communication is key. Let your staff know that you value company culture and that you’re taking decisive steps to preserve and advance it.

Tip #4: Partner with an M&A Consulting Firm

A merger or acquisition can be described as business as unusual because of its complex, high-stakes challenges. Most executives do not have to contend with the intricacies of an M&A event in their careers and therefore often find themselves in uncharted waters.

That’s why it’s important to work with a strategic consulting partner who has been through the process before. They can provide valuable experience and perspectives to keep you on point, on track and headed in the right direction.

At Finch Brands, we know that M&As are probably the most demanding change moment any company can experience and formulating an M&A strategy that incorporates all the elements you need to drive success isn’t a plug-and-play proposition. Given the stakes, it can be a very daunting process that you shouldn’t have to face alone.

Make Brand Decisions that Keep Talent in Place

Finch Brands has a proven track record of building and implementing M&A strategies that not only work, but also prioritize and optimize the employee experience. Contact us today to help you navigate the M&A process and make smart branding decisions that deliver the outcomes you’re looking for.

Finch Brands is a real-world brand consultancy that specializes in insights, strategy, and design, and has helped dozens of clients build successful post-M&A brands. We do this by helping clients win when it matters most by helping them own the change moment.