What Is An Insights Community? [Complete Guide]

What is an Insights Community?

An insights community is the next step in the evolution of market research. In the past, brands have tried to rely on their gut or intuition to make decisions. Then came phone surveys, online surveys, interviews, and market research focus groups. Today, brands can rely on something much more flexible, agile, and powerful- market research online communities (MROC) or consumer insights communities.

What is it? An insights community is your own custom-made, private research group, which uses advanced technology to channel the voices and opinions of thousands of members of your target audience to help inform a wide array of brand and business decisions on rapid timelines.

Insights communities offer a powerful way to engage with and understand your customers. They can be small or large, running for weeks or even years, with some communities focusing on qualitative feedback, others on quantitative data, or a combination of both.

Your consumer insights community can hold thousands of people split across many different segments to cover the widest range of market research questions – whether it’s loyal customers across the U.S., a certain profession of people globally, or people who consume your competitors’ products or services – insights communities are able to capture the perspectives of those audiences to get direct, thoughtful feedback. Discussions and activities should be structured, focused, and targeted so that they are only fielded to segments that research studies are relevant to. Communities can exist as a focused, priority-specific pop-up for as little as 3 to 6 months to facilitate agile and iterative learning plans where you “don’t know what you don’t know”, or continue on year after year to create a steady-state insights hub capability for your organization.

A modern insight community should allow for a broad array of quantitative and qualitative market research tools and techniques such as:

| Data Collection Tools | Research Methodologies |

|

|

Larger communities allow for much more sophisticated quantitative market research. Leading insights community solutions should include a powerful survey engine with capabilities such as:

| Question Types | Response Formats |

|

|

How Market Research Insights Communities Can Benefit Your Company

When you have your own engaged community of respondents, you can gain quick insight into the pulse of your target market within hours of asking. Or you can perform longer, multi-phase research projects that build on each other to uncover even deeper insights over time.

Compared to more antiquated research methods, you can recruit faster, get into the field more quickly, and get answers ahead of your competition. Essentially, insights communities help to turn a deeper understanding of your target audience into a competitive advantage. And you can lower your costs by recruiting your group once and performing multiple projects with them.

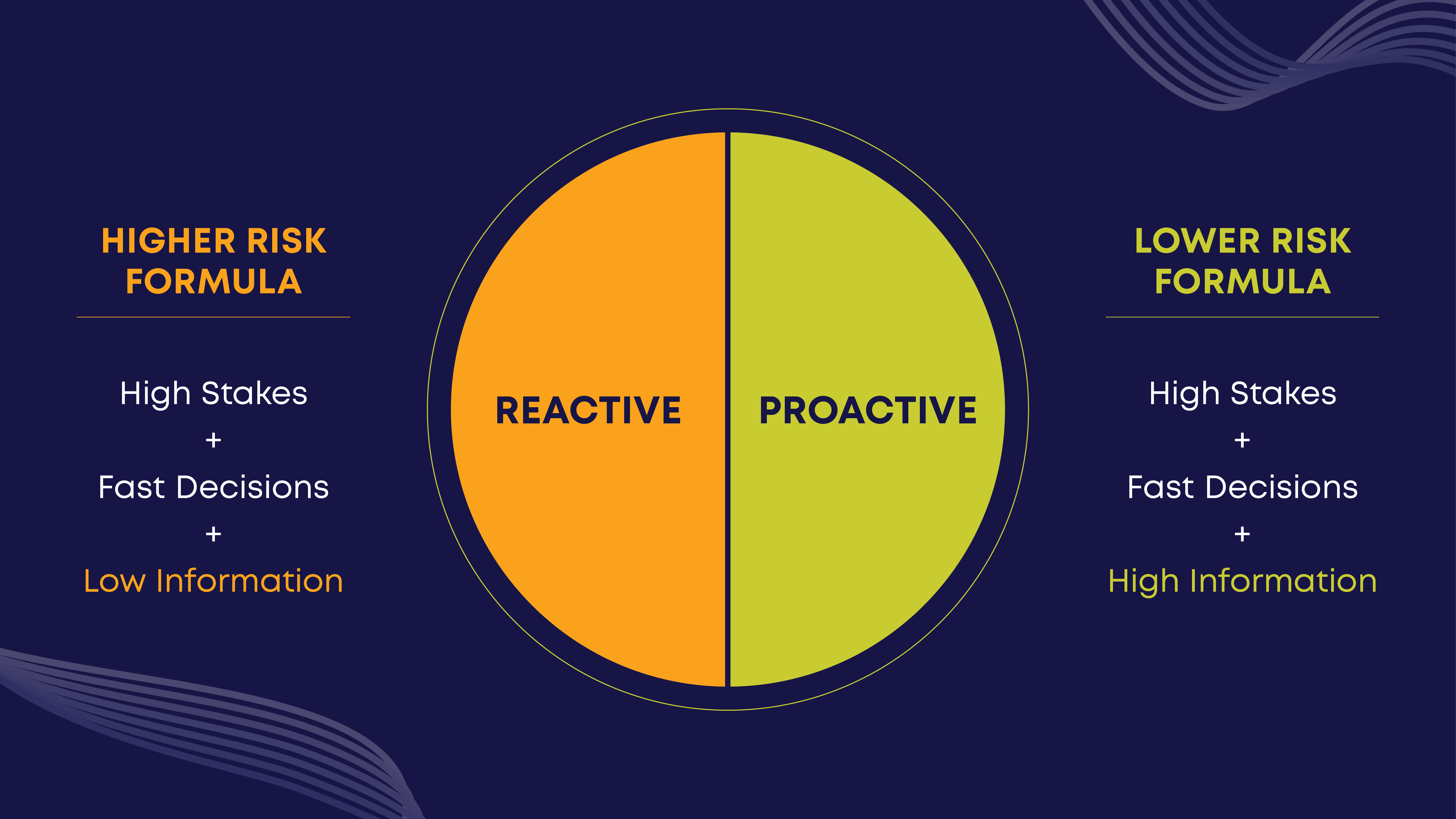

More organizations are also looking at insights communities these days as a way to de-risk decisions by moving from a reactive to a proactive means of making decisions. Across most industries, there are high stakes business decisions that need to be made on fast timelines. Those are fixed factors outside of any organization’s control if they want to compete in today’s marketplace. Traditionally, fast decisions typically meant low information. Boston Beer’s previous learning approach for these quick decisions wasn’t structured; rather it relied on gathering information on an ad hoc basis, leading to a lack of agile data collection. After adaptation, the “Happy Hour” community became an integral part of market research providing Boston Beer with relevant and accurate information in a timely manner. Read more about it here.

With customer insights communities, organizations can choose to invest and apply agile perspective through the voice of their target customers to provide much more information on those same fast timelines, effectively reducing risk for business-critical decisions.

What Industries Can Benefit From Customer Insights Communities?

The benefits of market research are not limited to any certain industry. Every industry needs data about their target customers and can use cutting-edge methods to turn that data into actionable insights.

A customer insights community works well for companies with one or more of these characteristics:

- Medium or large businesses

- Extensive portfolios of products and/or services

- A focus on innovation and new product development

- A need for fast insights and decisions

- Changing to be more customer-focused

- Lacking dedicated insight-generating personnel and resources

Common Consumer Insights Communities Projects

Your customer insights community can help you explore product ideas in the early stages more quickly, telling you what real customers will want. They can also give feedback on completed products or prototypes, trying them at home, if needed—giving insights into the true needs of your customers. This is exactly how Gap utilized their insight community, developing customer-focused solutions to aid the ongoing growth of their brand.

You can improve your marketing too. Your community can tell you if your benefits, proof points, and claims appeal to them. They can respond to your early campaign concepts, videos, and images.

Your insights community can improve the whole customer journey, helping you map it out. They can send members ongoing journals that document the processes they go through and how their needs are met or not met. They can record videos of their visits to stores or their uses of shopping websites.

Common Project Types Include:

- Concept testing

- Persona Building

- Brand Perception

- Ethnography

- Creative / Advertising Research

- Solution Ideation

- Topic Exploration

- UI/UX/CX Research

- Innovation Sprints

- Packaging Research

- Product Home Use Testing

- Sales Support Research

- Competitive Research

- Pricing Research

- And more…

How to Choose a DIY Insight Community Platform vs. Full Service

If you create your own DIY insights community you will:

- Allocate a lower marketing expense to it.

- Have greater control over it.

However, you may also:

- Struggle to learn how to manage it.

- Allocate more internal resources than you expect.

- Struggle if key employees leave the company or your org chart is restructured.

If you hire a full-service firm, you will:

- Enjoy an easy, fast implementation with a team that has managed insight communities before.

- Get new ideas from having an external team that uses technologies to their full potential.

- Need fewer internal resources.

- Have a higher expense in your budget (although this may be lower than the total resources you would use in a DIY community).

- Need to carefully select your partner and work with an experienced team.

You can also take a hybrid path. A partner can train your team members to perform certain tasks while managing other tasks in the community with hands-on support. You may be able to transition to owning an internal DIY community eventually from a full-service model if you choose the right partner with the right platform.

Evaluating Full-Service Insights Community Partners?

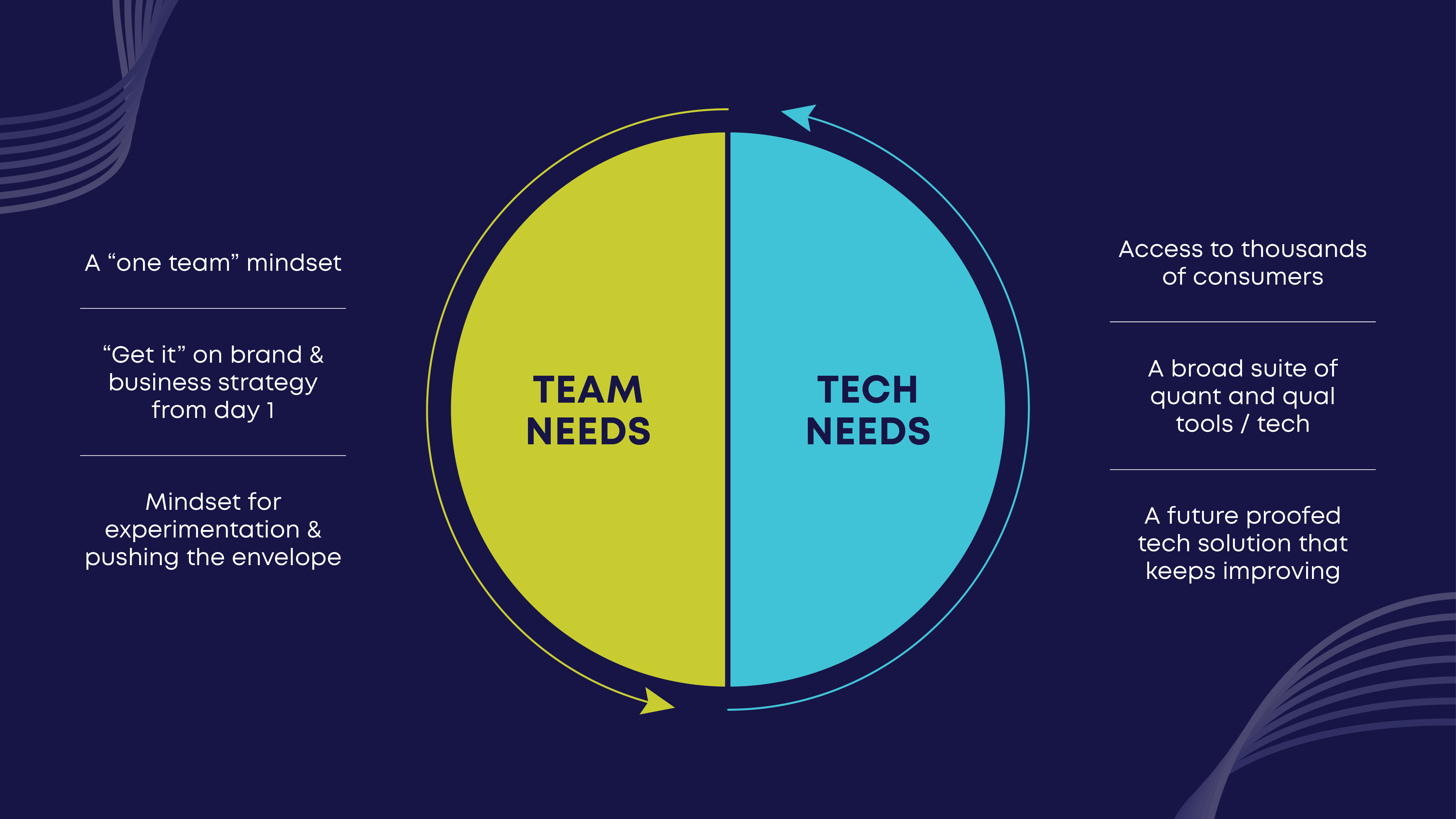

If you decide to go the full-service route you will need to count on a skilled, experienced team for your insight community management. The people involved are as important as the technology and insight community platform.

As you assess partners ask yourself does the potential team:

- Have the ability to act as one team with you?

- Contain expert researchers?

- Deliver both qualitative and quantitative results and insights?

- Use a variety of creative research methods? Are they innovative?

- Understand your business?

- Work hard and get things done?

- Connect insights to business strategy?

- Pull the story out of data?

- Have expertise in their technology platform?

- Have low internal turnover?

- Have a proven plan to recruit community members?

Then, think about the technology and its capabilities. Ask:

- How many members can be added?

- What can the survey engine do?

- How broad and diverse are the qualitative tools?

- Does it support video?

- Is it mobile-friendly?

- Does the developer add new features and improvements? How often?

Qualitative and Quantitative Market Research Methods from Insights Communities

Quantitative vs. qualitative market research—how do you choose? Marketing research focus groups of the past delivered only qualitative results. But today, you can get a community of thousands of members from an external provider, which can deliver both quantitative, statistically rigorous results and deep dives into qualitative data.

For quantitative data, you might look for:

- Dozens of different types of survey questions

- Analytics methods like MaxDiff analysis and Van Westendorp pricing

- Visual stimulus testing, such as heat mapping, hotspotting, highlighting, and more

- Advanced surveys, with innovative features, such as video upload

Qualitative methods should include:

- Virtual focus groups

- In-depth interviews

- Streaming video

- Screen sharing

- Recording shopping experiences through mobile apps

- Journals of experiences

- User experience testing

- Brainstorming sessions

- Online text- and image-based discussions

- Online whiteboards for idea creation

Measuring the Impact of Insight Communities

If you are working with an external partner, they will handle the steps of launching your insight community. Or you can go through these tasks yourself if you are using the DIY option. Steps include:

- Deciding whether the community will be formed under your brand name, will be free of branding, or will show your brand name to only some members.

- Sourcing the members from either third-party databases of respondents who have expressed interest in research participation, or inviting them from your own email lists.

- Creating an incentives plan to reward members, along with an engagement plan that creates emotional satisfaction.

How Can the Effectiveness of a Community Be Measured?

What is an insights community’s measure of success? You can track your results in terms of:

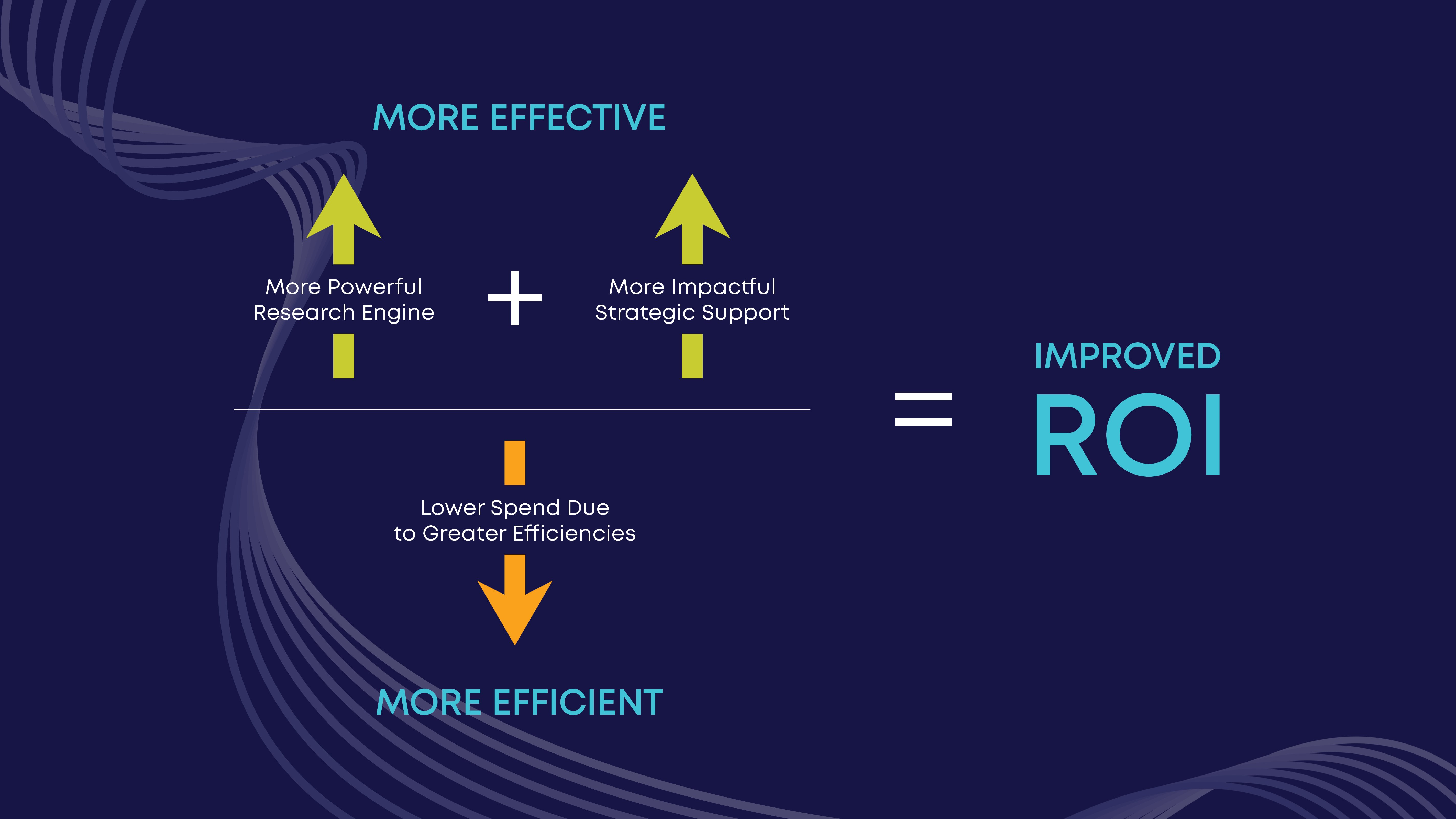

- Effectiveness: Your community insights should affect key business decisions. Your partner can gather results every week and track success stories throughout each year. Plus, your partner and members will get to know your brand better over time, giving increasingly better insights and more valuable answers to questions.

- Efficiency: Spending less while still enjoying great results.

Why Finch Brands is Different

That’s why we:

- Hire and train consultants to act as an extension of your team who are experts in both market research and brand strategy.

- Use cutting-edge software that has powerful quantitative and creative qualitative research abilities—and is updated frequently at no extra charge to you.

- Offer flexible solutions for each client.

- Train our researchers on a wide range of creative and effective research methodologies, along with how to get the most out of our powerful insight community technology.

- Use the most robust survey engine available.

- Gather qualitative data through contemporary technology tools, which can quickly gather insights on felt needs and experiences, even from large groups.

With more than 20 years of experience, Finch Brands can quickly bring you a large volume of high-quality data and insights. If you partner with us, your account team will consist of expert researchers who are experienced at connecting insights and brand strategy. And we use the latest technology, instead of legacy software.

You can get a custom online insights community from Finch Brands designed for both short- and long-term solutions. Find out how you can get the actionable consumer insights you need with Finch Brands insights communities consulting.